Feature Stories

- How Bangladesh bridged the gap between amateur and professional in government procurement

- Rated Criteria: Promoting Value in World Bank Procurement

- Public Procurement Transformation in Bangladesh

- Achievement of Value for Money and Enhancement of Efficiency, Economy and Transparency in Procurement - Document Archive System

Archives

- End-to-End Procurement Planning and Maintenance System Integrated with Project MIS

- Application of Construction Milestones in Rural Road Contracts of Nepal

- Gross National Happiness Model for Pursuing Sustainable Public Procurement

- Government procurement is the basis of wide opportunities for enterprise development

- The Challenges of Procurement Training in a Fragile Country: the Afghanistan Experience

- When and How to Open Contracts: Transparency and Engagement through World Bank Projects

- Innovations and Best Practices in Procurement Processes of Disaster Recovery Projects

- World Bank Experts Discuss Global Procurement Trends and Armenia's e-GP system with the National Assembly

- Technology driving transparent and accountable public procurement reform in Bangladesh

- Prototype for Implementation of Framework Agreement via Blockchain

- Construction Project Planning and Management Capacity Building in India: A Wholistic Approach to Boost Infrastructure Development

- Zimbabwe: Public Procurement reform to catalyze greater transparency and development

- 15th Procurement, Integrity, Management and Openness (PRIMO) Forum

- e-Procurement World Map

- Preventing and controlling corruption: A modern approach to Procurement

- 6th South Asia Public Procurement Conference held in Thimphu, Bhutan

- South Asia Procurement Innovation Awards 2018 Announced

- Procurement iNET completes 5 years and new CPPP Fastest 100% Challenge Launched

- Risky Business: Does Debarring Poor Performers Mitigate Future Performance Risk?

- Global Procurement Summit 2019, New Delhi, India

- World Bank India launches Survey for International Civil Works Contractors

- World Bank launches new Complaints Module in Systematic Tracking of Exchanges in Procurement (STEP) System

- New Open Contracting Data Standard for e-Procurement Systems Launched

- Bangladesh's success in public procurement: Sustained reform really pays off

- The five drivers for improving public sector performance: Lessons from the new World Bank Global Report

- South Asia Public Procurement Innovation Awards 2018

- Conversation with Khaled Elarbi, President, High Authority for Public Procurement (HAICOP), Tunisia on the Digitalization of Public Procurement

- Breaking the glass ceiling in Africa: Rwanda E-Government Procurement System

- How government e-marketplace is revolutionizing procurement in India

- Ensuring Value for Money in Infrastructure Projects - The Botswana way

- Blockchain Lessons for Procurement

- Botswana’s Benevolent Move to Enhance its Procurement Profession

- Achieving Better Value for Money Using e-Auction for Procurement of Goods by Public Sector - A Success Case from DPDC

- Guide to Project Management and Contract Management (GPMCM) – New Approach to Improve Efficiency and Effectiveness of Procurement Outcomes

- Regional Winners of SAPIA 2017 participate in 8th International Public Procurement Conference (IPPC 8) Arusha, Tanzania

- The Future of Public Procurement in the Era of Digitalization

- World Bank Operations Procurement Helping Turkey to Procure a US$2 Billion Gas Storage Facility

- Unlocking Energy Efficiency Market in India - Through Innovative Procurement Business Model

- Getting value for money: Creating an automated market place for farmers in Pakistan

- Towards a Single Market for Public Procurement in Caribbean Small States

- Web-Based Online Evaluation Tool (e-Tool) for Procurement of Works by Royal Government of Bhutan

- Strengthening Health Sector Procurement System Offer Hopes for Universal Health Coverage in Nepal

- Morocco makes Strides in Modernizing its Public Procurement System— Operationalization of the Procurement Regulatory Body

- Innovations in Procurement Process and Selection that Lead to Improved Outcomes – Tenderers’ Database Management System

- Looking Back and Forward: The World Bank’s Procurement Framework

- Independent Monitoring and Evaluation of Contracted Health Services Leads to Improved Outcomes in Rural Areas of Afghanistan

- Fifth South Asia Region Public Procurement Conference brings focus on Procurement in Public Service Delivery

- 12 Procurement Innovations from South Asian Countries Celebrated

- Social Media is Improving Procurement in Lao PDR

- ASEAN meeting explores ways of professionalizing public procurement to meet development challenges

- Second International Training Program on the World Bank’s New Procurement Framework

- South Asia Procurement Innovations Award 2017 launched with Bigger and Better Prizes

- How to bid, finding opportunities, what makes a successful bid

- Pushing boundaries in procurement framework implementation

- Experience of Developing PPSD for the Assam Agribusiness and Rural Transformation Project (APART), India

- An Electronic Approach: Streamlining Georgia's Procurement

- South Asia Heads of Procurement Knowledge Exchange Program to U.S. Government Procurement Systems started

- 13th Procurement, Integrity, Management and Openness (PRIMO) Forum - a Documentary

- Bangladesh to strengthen public procurement with World Bank supported Project

- Establishment of Technology-Based Health Procurement and Supply Chain Management System, and Capacity Development in Tamil Nadu Medical Services Corporation

- Towards a Single Market for Public Procurement in Caribbean Small States

- Redefining Procurement as an Innovative and Collaborative Centre of Excellence for Best-in-Class Sourcing Solution

- India’s PowerGrid Endorsed for Alternative Procurement Arrangements by the World Bank

- Achieving Value for Money in Indonesia’s Geothermal Project

- Citizen Monitoring of Rural Roads Under Pradhan Mantri Gram Sadak Yojana (PMGSY), India

- Establishment of Grant and Service Contract Management Unit (GCMU) to Manage Contracting Out of Health Services in Afghanistan

- Procurement for Regional Development–Public Policy Initiative in Sri Lanka

- PPAF Community-Driven Development (CDD) Procurement Model, Pakistan

- Making Successful Procurement of IT Systems - An Experience from Vietnam

- Procurement Observatories continue to deliver in India

- Implementation of National e-GP System in Nepal

- Government e-Marketplace (GeM), India

- Africa High Level Public Procurement and Electronic Government Procurement Forums

- Development of Procurement Cadre as Part of Holistic Procurement Reforms in Bhutan

- Modernizing Public Procurement in Zimbabwe, one Step at a Time

- Citizen Engagement During Public Procurement Implementation in Bangladesh

- Winter 2017 Virtual Procurement, Integrity, Management, and Openness (PRIMO) Forum on Sanctions and Debarment Systems

- Close and Personalized Procurement Monitoring, Leading to Procurement Efficiency in Irrigation Sector in Fragile and Challenging Environments of Afghanistan

- Procurement Framework 2016 offers wider choices to ‘Go to Market’ based on PPSD

- Procurement Framework 2016 - Benefits, Status of Roll-out and M&E Arrangements

- PPSD offers Fit for Purpose Procurement Solutions

- Global Procurement Summit

- Fourth South Asia Region Public Procurement Conference

- The World Bank e-Procurement Tools

- South Asia Procurement Innovations Awards, 2016

- Learning Videos launched on STEP, online tracking tool on procurement for World Bank Projects

- Open e-Learning is Building a Cadre of Procurement Experts

- South Asia Region Public Procurement Conference, 2017

- Online Certificate Program in Public Procurement in Arabic Launched in Egypt

- First Procurement Knowledge Exchange Forum among ASEAN Countries

- Nobel Prize in Economics for contribution to Theory of Contract

- The Africa Region Harnesses Integrated e-Government Procurement (e-GP) Systems in Pursuit of Transparency and Integrity

- Procurement Reform for Humanitarian and Development Challenges in Kurdistan Region of Iraq (KRI)

- Successful Procurement is not just a set of Activities, it is a Strategy

- Afghanistan - Trends and Recent Developments in Governance

- PPSD is an Opportunity for clients and staff for Improved Procurement Management

- Procurement Reform Advances in the MENA Region

- Data Analysis and Collaborative Work in Action for Expedited Disbursements in Africa

- Ensuring Good Governance in Procurement in Sri Lanka

- New Procurement System to Improve Development Impact and Transparency in South Asia

- World Bank, USTDA Formalize Procurement Partnership

- How the New Procurement Framework Will Benefit 45.6 Million People in India

- Procuring the Future

- Reasons to Bid, Finding Business Opportunities

- New World Bank Procurement Framework Promotes Strengthened National Procurement Systems

- The readiness for Procurement Framework 2016

- 6 Things to know about New Procurement Framework

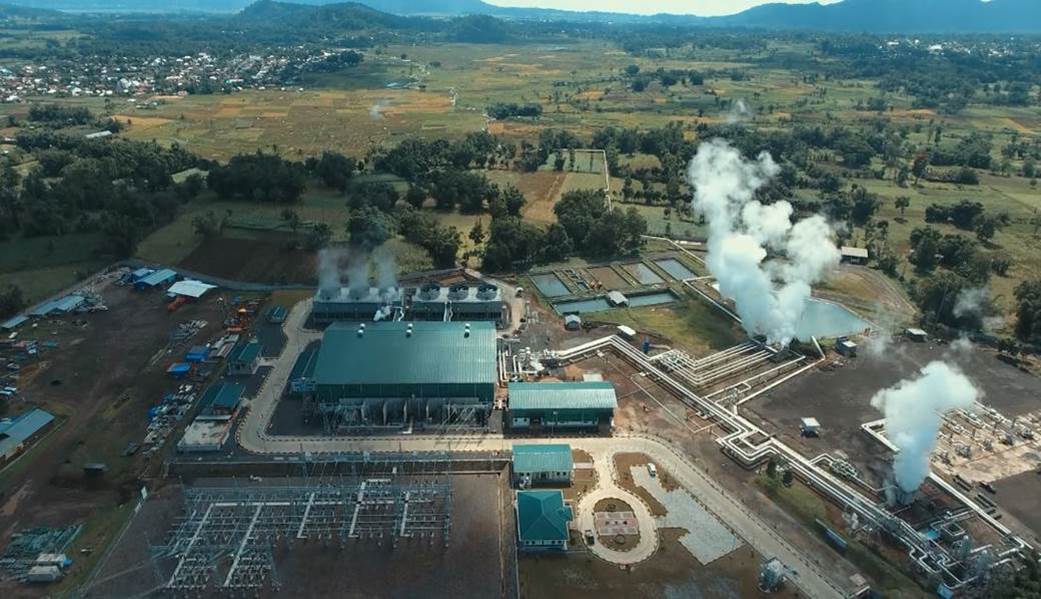

Achieving Value for Money in Indonesia’s Geothermal Project

Yash Gupta,

Senior Procurement Specialist and Huong Mai Nguyen, Energy Specialist

Pertamina Geothermal Energy (PGE) is a leading geothermal developer in Indonesia that has been in business since 1974. When the World Bank decided to support Government of Indonesia in geothermal energy in 2010, PGE was a partner of choice. Seven years later, the Project has consistently maintained Satisfactory status, and demonstrated that having an appropriate procurement strategy, effective contract management, pragmatic decision-making and a strong sense of ownership are key ingredients for successful management of large and complex infrastructure projects.

Under the Indonesia Clean Energy Investment Project, the Bank provided US$300 million – with US$175 from International Bank for Reconstruction and Development (IBRD) and US$125 from Clean Technology Fund (CTF) – to develop 150MW of geothermal capacity. This includes a 2x55 MW power plant in Ulubelu, Sumatera and 2x20MW plant in Lahendong, Sulawesi. By its completion, the Project is expected to contribute to an avoided emission of 3,000 ton of nitrogen oxides; 5,400 ton of sulfur dioxide; 2,500 ton of total suspended particles; and 1,100,000 ton of carbon dioxides compared to conventional coal-based power plant.

Effective implementation of the two subprojects in Ulubelu and Lahendong has been underpinned by good procurement and project management practices by PGE and the value for money, economy and efficiency it exemplifies. The Engineering, Procurement and Construction (EPC) contract for Ulubelu Project was signed in August 2014 for US$ 178 million and that for Lahendong project was signed in December 2014 for US$ 80 million. Both the contracts have been successfully implemented and projects commissioned on or ahead of schedule.

Photos by Muchsin Qadir

Photos by Muchsin Qadir

What led to the success of project?

- Appropriate Procurement Strategy: In selection of good contractors, a two-step approach with pre-qualification in first step by setting up appropriate pre-qualification criteria, and invitation of bids in second step from pre-qualified bidders on a single-responsibility basis laid a solid foundation for the success of the Project. Furthermore, the bidding processes for the two EPC contracts were sequenced so as to incorporate lessons from the bidding process for the Ulubelu project into that for Lahendong. This led to the improved quality of specifications, reduced number of pre-bid clarifications and deviations in the bids, and consequently faster turnaround throughout the procurement process for Lahendong. The total time from opening of bids to the signing of contract was reduced from eight-and-a-half months for Ulubelu to less than four months for Lahendong. A clear methodology for bid evaluation also provided the incentive for bidders to propose better delivery schedule, thus improving on overall project completion schedule.

- Client's ownership: As this was the first project with the Bank, PGE did not have any experience in World Bank's procurement procedures. Complementing PGE's professionalism was the enhanced implementation support provided by Bank staff for PGE's better understanding and implementation of the procurement processes for such large and complex procurement packages. This included explaining all aspects of bidding provisions and interpretations of contractual clauses at each stage of procurement process – from advertising to preparing responses to the bidders' queries, undertaking bid evaluation, pre-contract discussions and contract implementation stages. The excellent collaboration between the teams in PGE and the World Bank as well as the strong ownership and support from PGE's management has resulted in the successful conclusion of the contracts for both Ulubelu and Lahendong projects.

- Effective Contract Management: With Bank support, PGE proactively ensured effective supervision of both EPC contracts. With meticulous planning and prior coordination with the contractors on issues such as bank guarantees and release of advances, both EPC contracts were made effective from the date of signing – a most welcomed (and rare) achievement. PGE further ensured effective monitoring of progress in design and engineering, delivery of major equipment, and sufficient resource mobilization from the contractor early on. This allowed PGE to minimize delays that have been encountered in similar projects in Indonesia.

- Pragmatic Decision-Making for Better Outcomes: During contract implementation, PGE wanted to commission the second unit of the Lahendong power plant by December 2016, nearly three months ahead of the contracted schedule. As the contract did not provide for any bonus for early completion, this required stronger cooperation with the contractor. In view of the requirement for additional resource deployment by the contractor, PGE, in consultation with the Bank, implemented a contract variation, which in turn enabled the generation of 20MW to the grid nearly three months ahead of schedule. The economic benefits associated with revenue generation due to early commissioning of the plant, benefits to the households and industry through electricity supply, and greater greenhouse gas reduction have outweighed and well justified the nominal additional cost. This speaks volume of the understanding and considerations that PGE and the Bank together demonstrated in realizing the best value for money.